News

Categories

- Climate And Green News (30)

- Covid-19 News (30)

- Fintech News (84)

- Impact News (25)

- Industry News (36)

- Internal Update (4)

- Macro News (61)

- Policy/Regulation News (27)

- Press Release (16)

- SME News (34)

- Start up News (26)

Archives

- March 2024 (1)

- January 2024 (1)

- August 2022 (1)

- May 2022 (2)

- April 2022 (5)

- March 2022 (1)

- February 2022 (5)

- January 2022 (18)

- December 2021 (12)

- November 2021 (20)

- October 2021 (21)

- September 2021 (21)

- August 2021 (27)

- July 2021 (21)

- June 2021 (20)

- May 2021 (20)

- April 2021 (20)

- March 2021 (26)

- February 2021 (19)

- January 2021 (9)

Tags

Indonesia’s Sharia fintech market ranks fifth in the world and is dominated by millennials

Indonesia’s share of the Sharia fintech market is currently US$2.9 billion (or IDR 41.7 trillion), coming in fifth behind Saudi Arabia, Iran, United Arab Emirates and Malaysia. According to Adrian Gunadi, Chairman of Indonesia Fintech Association (AFPI) and CEO of

Xendit raises Series B to target MSMEs

Payment gateway fintech company, Xendit, raised Series B funding of US$64.6m (IDR938 billion) last month. The funds will be used to target the MSME sector, as it contributes to over 60% of Indonesia’s GDP and employs the majority of the

Survey results show that MSMEs are optimistic about the economy

MSMEs are optimistic about their businesses as the economy begins to show signs of recovery. This is in line with the BRI-MSME Index (BMSI), which has increased from 81.5 in Q4 2020 to 93.0 in Q1 2021. This is due

Digital wallets are more widely used than debit and credit cards during Ramadan month

Shopee, e-commerce giant, and Jakpat, market research firm, conducted a survey with 1,214 respondents to understand consumer behaviour during the Ramadan fasting month. The results revealed that 80% of respondents surveyed in April used digital wallets for transactions, while 56%

State-owned Enterprises have potential to support MSMEs

Institute of Development Economics and Finance (Indef) economist, Bhima Yudhistira, stated that State-owned Enterprises (SOEs) play an important role in the absorption of MSME goods. According to Bhima, through the job creation law, the central and local governments have the

Jokowi highlights development of world’s largest green industrial area in North Kalimantan

During the Leaders Summit on climate, President Jokowi discussed the development of the world’s largest green industrial area in North Kalimantan. As part of Indonesia’s net zero emission pilot programs, Jokowi invites innovation and investment in the country’s energy transition

Indonesia Financial Group partners with Bank BTN

Indonesian Financial Group (IFG) and PT Bank Tabungan Negara (BTN) are collaborating to optimise the digital banking ecosystem for customers. There are synergies between IFG and BTN that can provide consolidation, restructuring, transformation and business innovation services for the Ministry

Halodoc raises US$80 million in Series C funding

Health startup, Halodoc, received Series C funding of US$80 million (IDR 1.16 trillion). The investment was led by Astra, along with other investors including Temasek, Telkomsel Mitra Inovasi, Novo Holdings, Acrew Diversify Capital Fund, and Bangkok Bank. Halodoc CEO, Jonathan

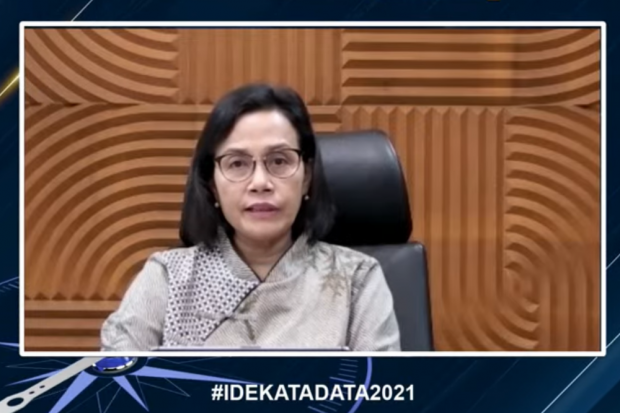

Women’s contribution to the Indonesian economy is predicted to be US$134.5 million by 2025

Finance Minister, Sri Mulyani, shared that women’s contribution to the Indonesian economy can reach up to USD$135 billion by 2025. She highlighted the importance of equal opportunities in the economy. She also shared that women can contribute up to US$12

Bank OCBC NISP became the first bank to receive green bond

Bank OCBC NISP is the first bank in Indonesia to receive a green bond from IFC, valued at US$190 million (IDR 2.75 trillion). President Director, Parawati Surjaudaja, shared that the funds would be used to increase lending to women-owned SMEs.