News

Categories

- Climate And Green News (30)

- Covid-19 News (30)

- Fintech News (84)

- Impact News (25)

- Industry News (36)

- Internal Update (4)

- Macro News (61)

- Policy/Regulation News (27)

- Press Release (16)

- SME News (34)

- Start up News (26)

Archives

- March 2024 (1)

- January 2024 (1)

- August 2022 (1)

- May 2022 (2)

- April 2022 (5)

- March 2022 (1)

- February 2022 (5)

- January 2022 (18)

- December 2021 (12)

- November 2021 (20)

- October 2021 (21)

- September 2021 (21)

- August 2021 (27)

- July 2021 (21)

- June 2021 (20)

- May 2021 (20)

- April 2021 (20)

- March 2021 (26)

- February 2021 (19)

- January 2021 (9)

Tags

Investing in Southeast Asia’s digital economy

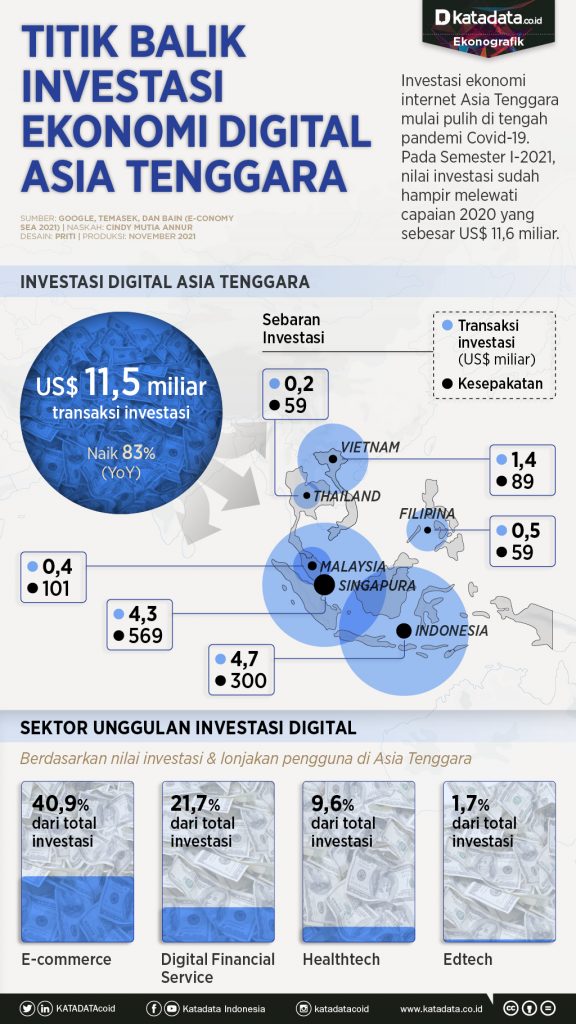

The e-Conomy Sea 2021 report shows that Southeast Asia’s internet economic investment has started to recover amid the Covid-19 pandemic. The value of investment transactions in the region reached US$ 11.5 billion, up 83% year-on-year. The value of investment transactions

Fintech companies make the case for alternative credit scoring using big data

Data from the Financial Services Authority (OJK) shows that 70% of Micro, Small and Medium Enterprises (MSMEs) in Indonesia have yet to access financing from banks, due to weak financial assets and poor data transparency. Consequently, fintech companies plan to

State-Owned Banks project up to 10% in credit growth for 2022

State-owned banks are optimistic about the economic recovery, with a number of banks projecting credit growth to reach 10% by 2022. Both BRI and BTN estimate that credit distribution in 2022 to have year-on-year growth at 8-10%. BRI’s lending focus

OJK launches roadmap for BPR industry development

OJK has officially launched a Roadmap for Indonesian Banking Development (RP2I) 2021 – 2025 for the Rural Banks (BPR) and Sharia Rural Banks (BPRS). BPRs and BPRS are expected to unlock synergies from the wider financial services ecosystem, and increase

OJK drafts regulation to limit institutional lenders to fintechs

OJK is drafting regulations that will limit institutional lenders from funding fintech peer-to-peer lenders. OJK’s new regulation involves setting distinct criteria for institutional lenders, specifically for overseas capital. For local capital, a bank is able to fund up to 25%

Bank Neo Commerce and Nikel offer financing to the Indonesian healthcare sector

December 2, 2021 – Bank Neo Commerce (BNC), an Indonesian digital bank and Nikel, an embedded lending technology company, have partnered to offer affordable financing to the Indonesian healthcare sector during the COVID-19 pandemic. One of the projects is providing

Indonesia needs IDR 3,779 trillion to achieve NDC climate targets

Deputy Minister of Finance, Suahasil Nazara, shared that the estimated cumulative cost needed by Indonesia to mitigate climate change and meet its national targets (NDC) is at US$ 265.5 billion (IDR 3,779 trillion) by 2030. According to NDC, Indonesia is

GoTo marketplace reaches IDR 420 trillion in transactions

GoTo, a joint entity of Gojek and Tokopedia, recorded total transactions of US$ 29.4 billion (IDR 420 trillion) for 2021. GoTo CEO, Andre Soelistyo, illustrates that Gojek and Tokopedia seek to build a digital bridge (marketplace) for micro, small and

The rise in digital economy for the region, but Indonesia faces deficit in digital talent

In a recent report by Google, Temasek and Bain, it is estimated that Southeast Asia’s digital economy will be at US$146 billion (IDR 2,080 trillion) by 2025. However, there are three challenges to overcome: digital talent deficit, data regulation, and

Fintech credit distribution to MSMEs sector increases

OJK noted that the distribution of credit by fintech lenders to the productive sector continues to increase, reaching US$ 8 billion (IDR 114.76 trillion) as of October, and 43.6% of the total disbursements are channeled to productive sectors. In 2020,