News

Categories

- Climate And Green News (30)

- Covid-19 News (30)

- Fintech News (84)

- Impact News (25)

- Industry News (36)

- Internal Update (4)

- Macro News (61)

- Policy/Regulation News (27)

- Press Release (16)

- SME News (34)

- Start up News (26)

Archives

- March 2024 (1)

- January 2024 (1)

- August 2022 (1)

- May 2022 (2)

- April 2022 (5)

- March 2022 (1)

- February 2022 (5)

- January 2022 (18)

- December 2021 (12)

- November 2021 (20)

- October 2021 (21)

- September 2021 (21)

- August 2021 (27)

- July 2021 (21)

- June 2021 (20)

- May 2021 (20)

- April 2021 (20)

- March 2021 (26)

- February 2021 (19)

- January 2021 (9)

Tags

Women Empower Women (“WOW”) Event

Jakarta | Friday, 8 March 2024 | International Women’s Day Finclusion and WEConnect International present Meeting Capital and MarketOpportunities for Women Entrepreneurs Jakarta, March 2024. WOW Event 2024 celebrated International Women’s Day with the theme – Inspire Inclusion. Finclusion and

USAID and Nikel introduce Bu Mira, revolutionizing business growth for Women-led Small and Medium Enterprises (“W-SMEs”) in Indonesia

Jakarta, January 2024. In an exciting partnership, Nikel and U.S. Agency for InternationalDevelopment (“USAID”), proudly introduce, Bu Mira, the business partner who will helpWomen-SMEs grow their business through education modules, financial tools and loanapplications, all through WhatsApp. Bu Mira is

Cheng Xing joins Nikel as Chief Product Officer

Aug 2022 – Cheng Xing has joined Nikel as Chief Product Officer effective July 2022. Cheng has more than 20 years’ experience in Retail & SME banking, across lending, payments and digital transformation. Cheng was previously Head of Delivery at

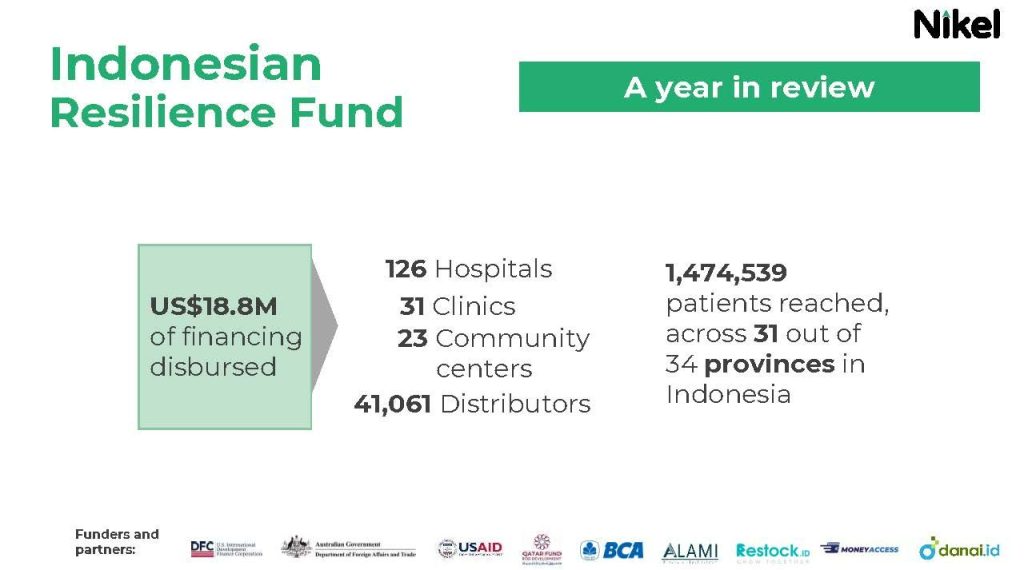

Indonesian Resilience Fund – A year in review

Celebrating one year of progress on the Nikel-managed Indonesian Resilience Fund. We believe it’s imperative for Indonesia’s economic recovery and resilience from C-19 pandemic to provide liquidity to the healthcare and essential goods delivery sectors. Since launching in March 2021,

A fresh take on SME Lending – Indo Tekno Podcast

Reinier Musters the CEO of Nikel joins Indo Tekno Podcast to review the latest breakthroughs in online SME lending in Indonesia, including critical improvements in credit scoring. Nikel, a company that Reinier founded in early 2019, has championed “embedded lending”, a turnkey

Jokowi’s plan to digitise Indonesia’s economy

Digitisation of the economy is one of the focus areas for Indonesia’s growth. President Joko Widodo (Jokowi) is targeting a minimum of 20 million MSMEs to enter the digital ecosystem in 2022, followed by 24 million by 2023, and 30

Indonesia’s telecommunication sector faces fierce price competition

Internet tariff in Indonesia is the 12th cheapest globally, according to a cable.co.uk report. Cellular operators warned that this may threaten the sustainability of the telecommunications sector in the country. The average price for mobile internet packages in Indonesia is

AFPI highlights the trend of fintech P2Ps acquiring banks

There has been interest from fintech P2P lenders to acquire banks, as part of their efforts to increase share of MSME lending in Indonesia. Most recently, P2P fintech, Amarta, was reportedly in talks to acquire Bank Victoria Syariah by taking

Indonesia’s interest rates for deposits will continue to decline at a slower rate for 2022

The Deposit Insurance Corporation (LPS) estimates that the interest on deposits will continue to decline but at a slower rate. The decline in interest rates has slowed down since the end of 2021, while liquidity conditions are still positive. At

IMF highlights three global risks that can slow down Indonesia’s economic recovery

The International Monetary Fund (IMF) highlighted three global risks that may overshadow Indonesia’s economic recovery. The first risk is the uncertainty of the pandemic, driven by low vaccination rates, risks of lockdowns and the emergence of new variants. The second